Report 2024

Deforestation Regulation Readiness

Regulations like the UK Environment Act and EU Deforestation Regulation are soon coming into force. Is your company ready to meet the requirements? Hear from your peers by downloading our 2024 Report from 300 Timber & Forest Risk Commodity Operators across Europe.

Regulation countdown for Enterprises

Why you need to prepare for the incoming deforestation regulations

Incoming deforestation regulations like the EU Deforestation Regulation (EUDR) are set to reshape businesses involved in forest-risk commodities, requiring them to adapt their supply chain practices to meet strict criteria for traceability and sustainability. Improving due diligence enhances reputation by aligning with regulation, consumer demand and improving business efficiency.

These regulations have been introduced to address environmental concerns such as deforestation, climate change, and human rights abuses. Businesses engaging with their provisions can contribute to global conservation efforts and gain a competitive edge by positioning themselves as leaders in sustainability, attracting conscientious consumers and investors. Proactive integration of these measures mitigates legal risks and fosters a more sustainable future.

Deforestation Regulation Readiness: Key Findings

In January 2024, we collaborated with Censuswide to survey 300 Timber and Forest Risk Commodity Operators throughout Europe to gauge their preparedness, concerns, and perspectives in anticipation of forthcoming deforestation regulations. These were our key findings:

Unawareness of any

deforestation regulations

The analysis extends to country-specific responses, highlighting a disparate state of readiness. For instance, 44% of UK respondents feel somewhat prepared, contrasting sharply with Belgium, where 24% have not yet commenced preparations. This disparity underscores the implications of varying levels of preparedness across borders, emphasising the need for a unified approach to compliance and risk management.

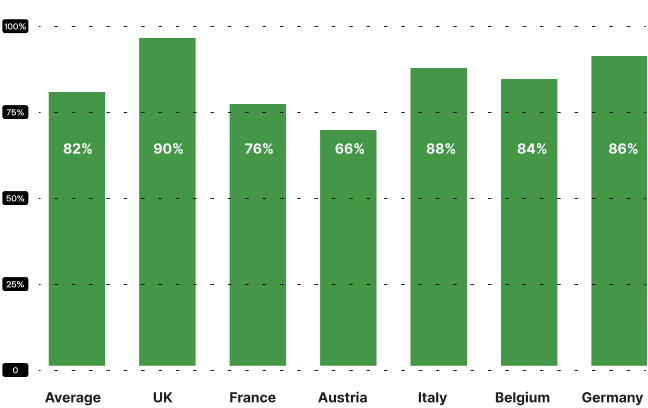

Time spent on tracking down customer information

A staggering 82% of organisations reported dedicating more than half of their operational time to tracking customer information. This figure rose to 90% within the UK.

These numbers underscore a persistent challenge in operational management and the need for more efficient processes, especially with the looming implementation of regulations like the EUDR just eight months away (as of April 2024) for large enterprises.

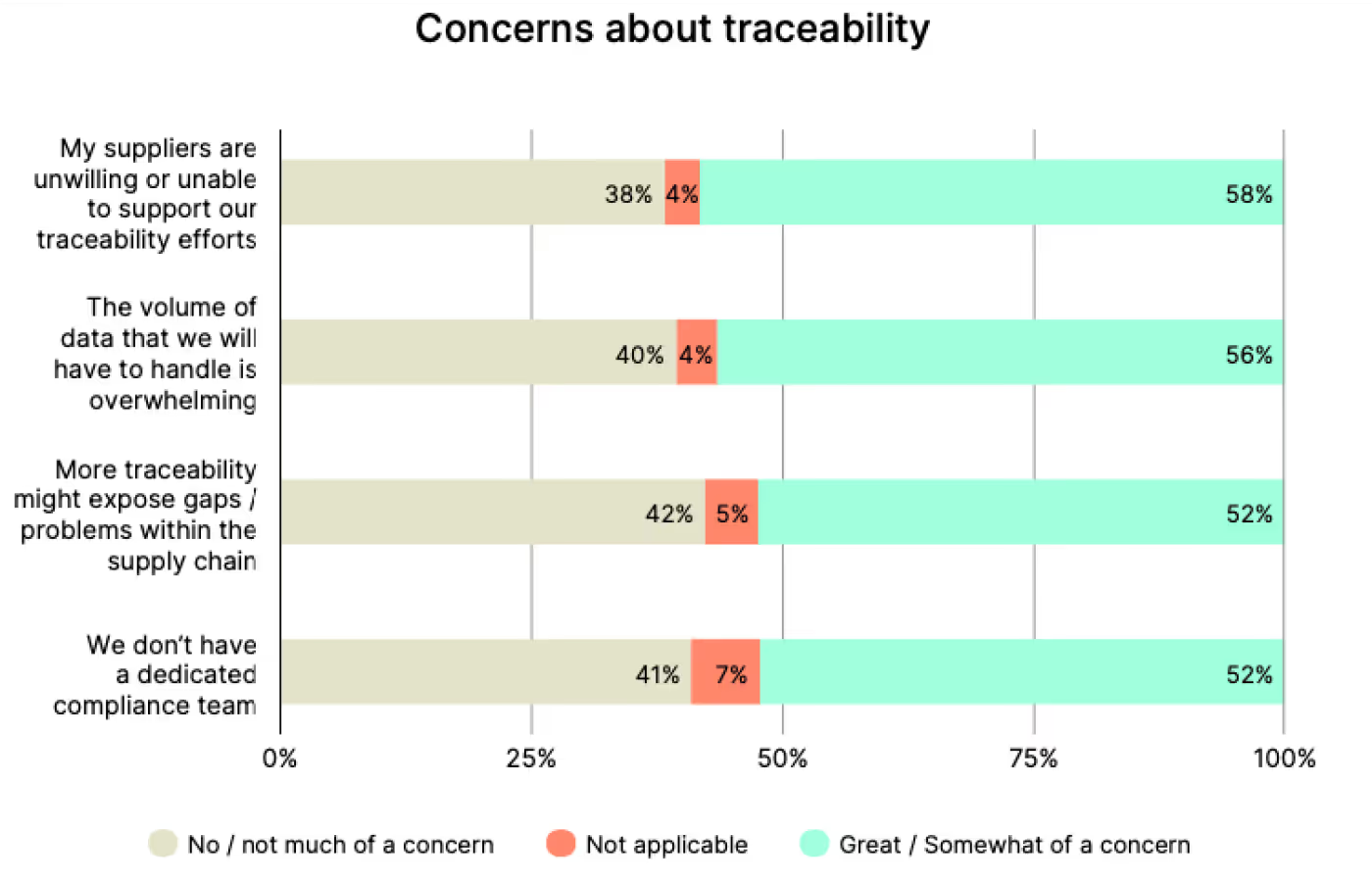

Supplier challenges hindering traceability efforts

Concerns surrounding the push for increased traceability within supply chains were significant, reflecting apprehension about the readiness and capability of both suppliers and organisations.

A notable 58% of respondents indicated that their suppliers were unwilling or unable to support their efforts towards enhanced traceability, presenting an obstacle to compliance and operational transparency.

This concern was consistent across all company sizes. Enterprises expressed greater concern (65%) compared to small and medium-sized companies (49% and 56%).

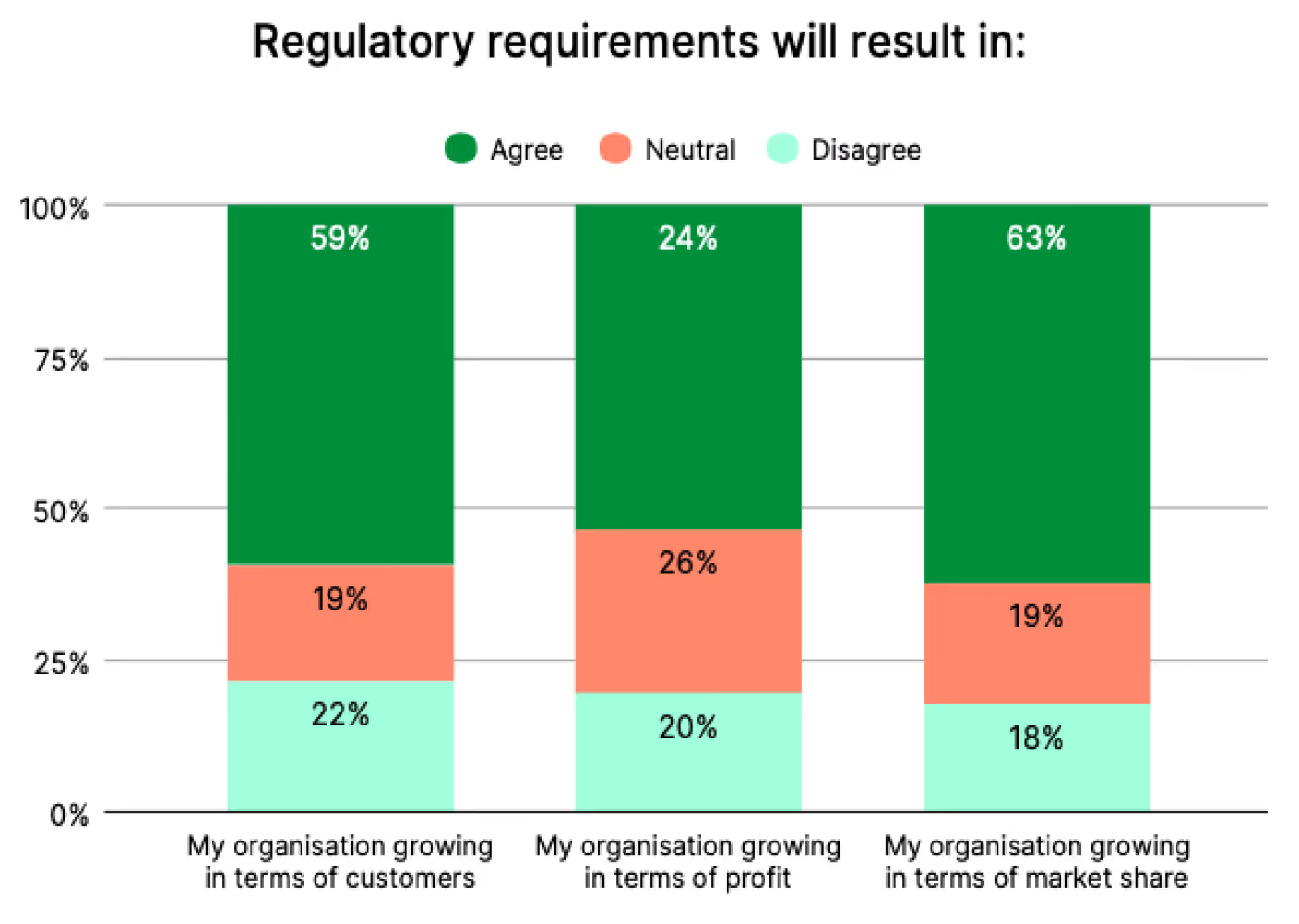

Growth prospects linked to regulations

Notably, larger organisations expressed more positive sentiments. For example, almost twice as many Enterprises felt that regulations would have a positive impact on customer growth, profitability, and market share compared to the smallest of companies (<50 employees).

This disparity may signal the resources available to Enterprises or their experience with the implementation of other transformative regulations.

Growth potential with traceability solutions

Additionally, 53% of organisations acknowledged that traceability systems would significantly streamline the sourcing of timber. Moreover, 51% expressed eagerness to implement such solutions, highlighting widespread recognition of its benefits.

Solutions such as Interu are exceedingly valuable in helping not only solve the challenges raised in this survey, but also harness the opportunities they present. This is because Interu provides the tools that effectively manage vast datasets and proactively pinpoints and tackles supply chain weaknesses before they escalate into regulatory or reputational risks. This method not only supports compliance but also enhances the resilience and transparency of the supply chain network, transforming potential challenges into prospects for advancement and expansion.

“We are at a critical time in the timber industry. With sweeping new regulations on the horizon, it’s essential that those in the sector ready themselves. Our research shows a degree of openness among importers in Europe to get ahead of these regulations, but there remains hesitation and a lack of understanding of how traceability solutions can support them. Distributed Ledger Technology (DLT), is perfectly placed to help businesses increase the traceability of their timber in the face of the upcoming regulation changes, as well as build bonds of trust across the entire timber ecosystem.”

Learn more about this topic

The Impact of the EU Deforestation Regulation on the Paper Industry

With just 6 months until Enterprises need to be EUDR compliant, we explore how increased due diligence is reshaping the paper industry, and what you need to do today to ensure compliance.

Introducing geolocation

Unlock insights on Timber importers' compliance with the EU Deforestation Regulation (EUDR). Discover key takeaways, starting with the crucial aspect of geolocation.

%20(1).avif)

From Intent to Implementation: Sharing EUDR Data with Customers and Suppliers

Discover how to move from EUDR intent to implementation. Learn what data to share, how to share it, and how Interu simplifies compliance across supply chains.